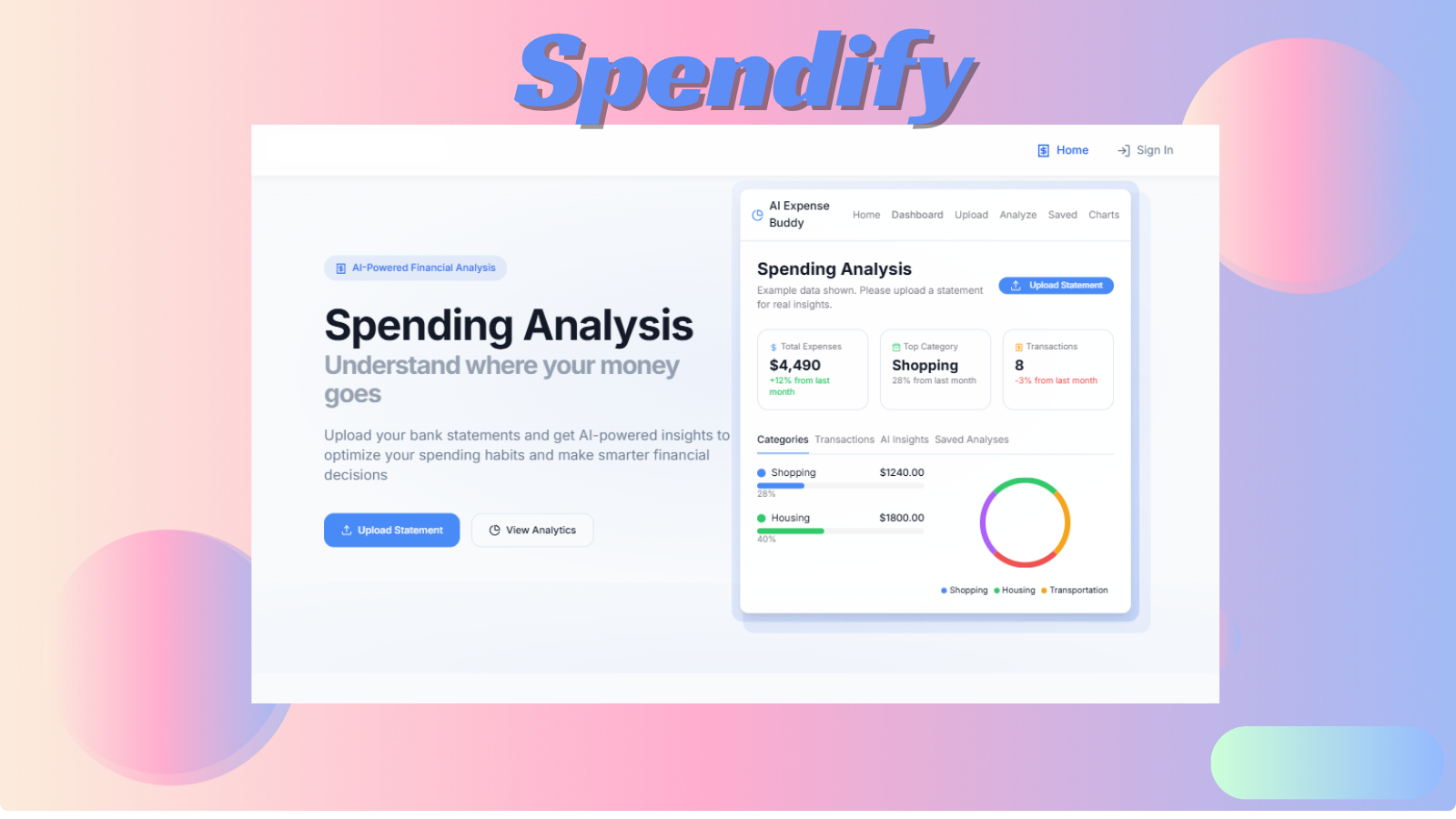

Track your spending, detect hidden subscriptions, forecast bills, and optimize your finances — automatically.

Spendify 2.0 is the next evolution of personal and business money management.

Using advanced Al + automated data processing, it helps you:

• Understand where your money goes!

• Detect recurring subscriptions instantly • Predict future spending

• Spot price increases

• Find low-value or forgotten subscriptions • Build intelligent budgets

• Merge multiple bank statements

• And optimize your finances with zero effort

If you've ever looked at your bank account and thought "Where did my money go?". ….. Spendify 2.0 was built exactly for you.

Why Spendify Exists

Traditional budgeting tools show you numbers. Spendify shows you insights, forecasts, risks, and savings opportunities - powered by Al.

Stop manually tracking expenses. Stop guessing when a subscription renews.

Stop overpaying without knowing.

Spendify gives you full financial clarity — automatically.

From confusion to confidence – Discover hidden leaks, reduce unnecessary expenses, and make better financial decisions fast.

What Makes Spendify Different?

AI Full Parse (Advanced Statement Intelligence)

AI Full Parse transforms raw bank statements into structured, actionable financial intelligence.

This feature fully analyzes uploaded bank statements — line by line — extracting, categorizing, and interpreting all financial data automatically.

What AI Full Parse Does:

-

Parses every transaction

-

Detects vendors, categories, and patterns

-

Identifies recurring charges and subscriptions

-

Normalizes inconsistent statement formats

-

Handles multi-bank, multi-currency data

-

Builds a clean, structured dataset

Data Extracted

-

Transaction date

-

Merchant name

-

Amount (credit/debit)

-

Category

-

Recurrence indicators

-

Subscription confidence score

-

Monthly & yearly totals

Advanced Intelligence

-

Hidden recurring charge detection

-

Irregular subscription identification

-

Price increase detection

-

Long-term spend patterns

-

Anomaly detection

-

Monthly and yearly forecasts

Supported Formats

-

PDF bank statements

-

CSV exports

-

Multi-month uploads

-

Multi-bank statements

Why AI Full Parse Matters

-

Bank statements are messy and inconsistent

-

Manual review is slow and error-prone

-

AI Full Parse converts chaos into clarity

This is the foundation layer that powers Subscription Manager 2.0, AI Insights 2.0, budgeting, and forecasting.

How These Features Fit into Spendify

Together, they form a complete financial automation system.

Upload multiple months of statements and Spendify will:

-

Merge them intelligently

-

Detect new subscriptions

-

Detect canceled ones

-

Identify long-term price increases

-

Spot spending patterns

-

Build a financial timeline

Subscription Manager 2.0

The most powerful subscription detection engine we’ve ever built.

Automatically detects:

-

Monthly & yearly recurring payments

-

Price increases

-

Hidden small charges

-

Next billing dates

-

Cancellation difficulty

-

Vendor categories

-

Forecasted yearly cost

-

Spending trends (increasing, stable, decreasing)

AI Budget Builder

Upload statements → Spendify instantly builds a personalized, smart budget for you.

Includes:

-

AI-defined categories

-

Overspending alerts

-

Recommended budget allocations

-

Monthly & yearly projections

AI Invoice (Prompt-to-Invoice)

Create professional invoices instantly using AI — no templates, no manual formatting.

AI Invoice allows users to generate complete, ready-to-send invoices from simple prompts, uploaded statements, or transaction data.

Just describe what you need — Spendify handles the rest.

How It Works

-

Enter a short prompt (e.g. “Create an invoice for web design services, $500, due in 7 days”)

-

Or select transactions from a bank statement

- AI automatically generates a structured invoice

Who's Spendify for?

-

Freelancers & Solopreneurs – Manage multiple income streams, keep expenses organised, and simplify tax preparation.

-

Students & Remote Workers – Track tight budgets, monitor daily spending, and build healthy savings habits.

-

Small Business Owners – Gain financial clarity without relying on complex accounting software.

-

Privacy-Conscious Individuals – Anyone who wants actionable insights from their spending without the need to link a bank account.

Why Spendify 2.0 Beats Every Other Tool

-

Not just tracking — intelligence

Other tools show transactions. Spendify explains what they mean and what to do. -

Not just categorization — detection

Spendify automatically finds subscriptions and hidden recurring bills. -

Not just reports — forecasts

12-month predictive analytics powered by AI. -

Not just budgeting — smart budgeting

Plans made specifically for each user’s spending habits. -

Not just cross-platform — universal

Works with any bank in the world.

Use Cases

- Freelancer Tax Prep - Upload yearly statements to auto-tag tax-deductible expenses.

- Startup Cash Flow Tracking - Visualize inflows/outflows to manage runway.

- Subscription Management - Detect hidden recurring charges like Saas tools or memberships.

- Family Budgeting - Upload joint account statements for smarter household planning.